Travel Credit Card

Latest News

Overview

The Travel Card is for employees who must travel on behalf of the University. Cardholders can use the card to pay for all expenses related to official University business travel. The Pcard can no longer be used for employee travel expenses. Purchases of goods or services not directly related to University travel are not permitted.

The card can only be used for State funded travel transactions (including lodging, parking, meals, etc.); therefore, Auxiliary travel purchases cannot be made with this University card. The Travel Desk will review and monitor all cardholder purchases. Review the CSUDH Travel Card Policy & Procedures [PDF] for more information.

A CSUDH faculty or staff member is eligible to apply for a Travel card by meeting the following criteria:

- Their employment classification must be faculty, staff, or annually renewable (temporary staff, student employees, emergency hires, retired annuitants, and volunteers are not eligible); and

- Their position at the university requires business travel at least once each year; and

- The card has been authorized by the cardholder's appropriate administrator; and

- The individual has completed the Travel Card Request Form and agrees to adhere to card procedures and all related CSU applicable policies and procedures, including the campus travel procedures.

A Travel Card Request Form must be completed by the employee in order to obtain a travel card. Completed forms with necessary approval signatures should be submitted to travel@csudh.edu.

After reviewing and verifying eligibility, the Travel Desk will assign the CSU Learn Travel Card certification course to the card requester, via email.

After a passing score (100%) is achieved, the Travel Desk will request the card from the issuing bank. The card should generally be received by the Travel Desk within 10 business days. The Travel Desk will load the card number into the cardholder’s Concur profile and will remove any personal cards on file. The cardholder will be notified when the card is ready to be picked up.

The card is to only be used for official state business travel charges and the cardholder is responsible for reconciling card activity by attaching charges to related travel expense reports in Concur Travel & Expense platform.

The card is specific to the cardholder and all activity feeds to the cardholders Concur profile to be expensed for a trip. The card is not to be used as a “department card” to pay for travel elements on behalf of others. If traveling with a student group, a cardholder may cover certain expenses for others traveling; please contact the Travel Desk a travel@csudh.edu to discuss when this might work and what impact this has on the traveler’s travel request.

The Cardholder is responsible for the following:

- Appropriate usage - The card must be used in accordance with the language in these procedures. In addition, purchases must be in compliance with CSU/campus travel procedures and may only be used for bona fide business travel expenses that directly serve university purposes. TRAVEL CARDS MAY NOT BE USED FOR PERSONAL PURCHASES. Please note that card activity is subject to Public Records Act requests. In the case of personal charges, infractions will be issued for each occurrence and CSUDH will pursue all measures necessary to collect balances owed. Additionally, unpaid balances older than 60 days may result in suspension of travel card.

- Cardholder is responsible for reconciling card activity by submitting all itemized receipts, including those under $75, with travel expense report via Concur Travel & Expense platform. Each missing itemized receipt is considered an infraction.

- Meal charges exceeding the daily limit and alcohol purchases are considered personal charges and will result in a balance owed to the University. Alcohol should be purchased separately and not on the travel card. In the case of personal charges, infractions will be issued for each occurrence and CSUDH will pursue all measures necessary to collect balances owed. Additionally, unpaid balances older than 60 days may result in suspension of travel card.

- Monitor activity – Protect the card at all times to prevent unauthorized use and guard against fraudulent activity.

- Dispute transactions in a timely manner - It is important to dispute any charges attached to your card with the merchant and US Bank within 60 days of the transaction posting date. Disputes can be made by calling US Bank at 1-800-344-5696.

- Report lost or stolen cards – In the event that a card is lost, stolen or fraudulent activity is detected, immediately contact US Bank at 1-800-344-5696. US Bank will work with cardholders/campus to resolve the problem and issue a replacement card when necessary.

- Surrender use of card – The cardholder must discontinue use of the card by notifying Travel Desk at travel@csudh.edu. Card can be shredded or turned into the Accounts Payable office in Welch Hall 430.

- Upon separation from the university, the card will be cancelled in accordance with the campus separation process.

If the travel card is declined for a particular transaction and the reason is unclear to the cardholder, please contact US Bank Customer service at 1-800-344-5696 or the Travel Desk at travel@csudh.edu.

Common reasons for declined transactions include the following:

- Merchant has the incorrect card number, expiration date, or security code

- The transaction cost exceeds the card’s allowable limit (either single purchase or monthly limits)

- The card is being used at a high-risk establishment restricted by the university based on the merchant category

All cards will be issued with a $3,000 spending limit. To later request either a permanent or one-time change in cardholder purchase limits, the cardholder’s Fiscal Officer/ARM shall email Travel Desk at travel@csudh.edu. The email must contain:

- The requested credit limit increase

- The justification for the increase

- Whether the requested increase is one-time or permanent

The card will expire on the date noted on the card and will be automatically renewed unless:

- The card has inactivity for 12 consecutive months

- The card has been revoked due to misuse

- The cardholder has separated from the university

Cardholders who have made inappropriate purchases not related to university business travel are subject to the following process:

Three infractions in a six month period will subject the cardholder to a thirty day suspension. The cardholder will be required to attend a refresher training to reinstate travel card privileges. Two suspensions in a six month period will result in the revocation of travel card privileges and card cancellation. Travel card infraction notices will be issued at the conclusion of each cycle closing.

Travel Card Issues & Corrections

If you exceeded your daily meal allowance while using your Travel Card, you will indicate it while preparing your Expense Report.

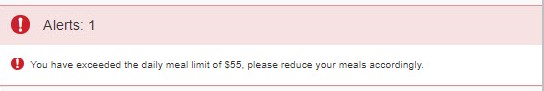

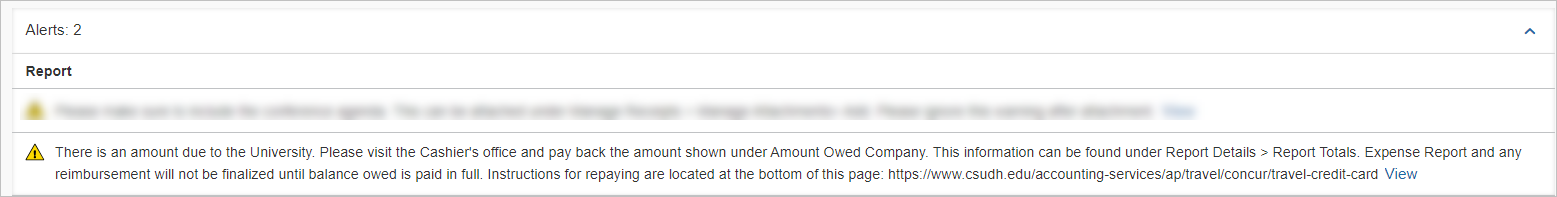

You will see an alert that you have exceeded the limit.

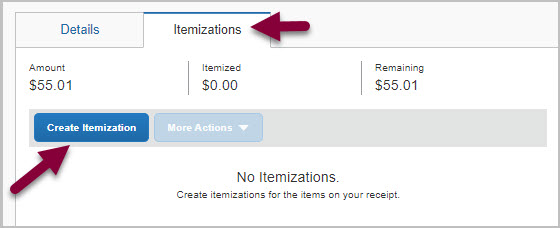

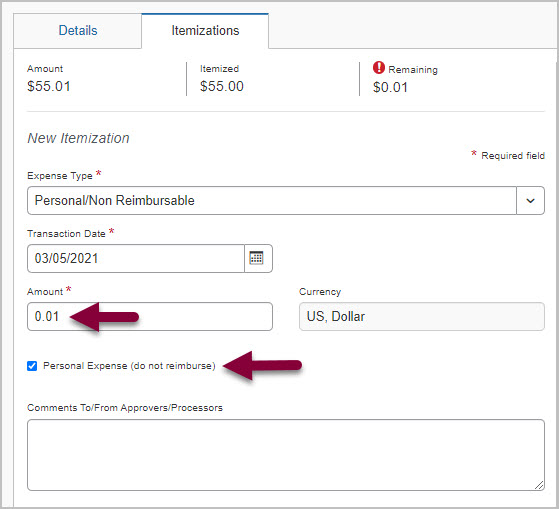

- Click on Itemizations, then Create Itemization.

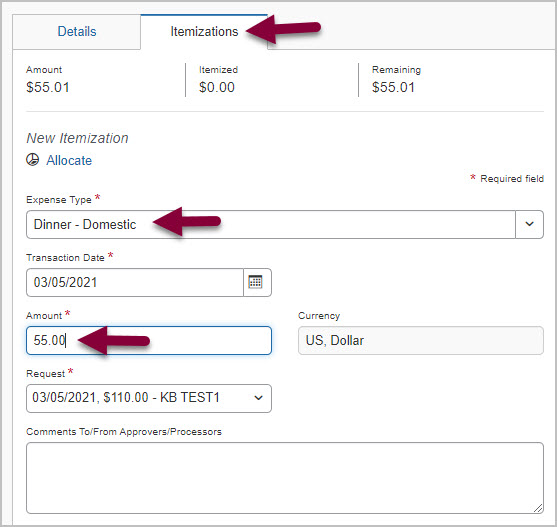

- Under the itemization, select the appropriate Expense Type, then enter the maximum amount allowed.

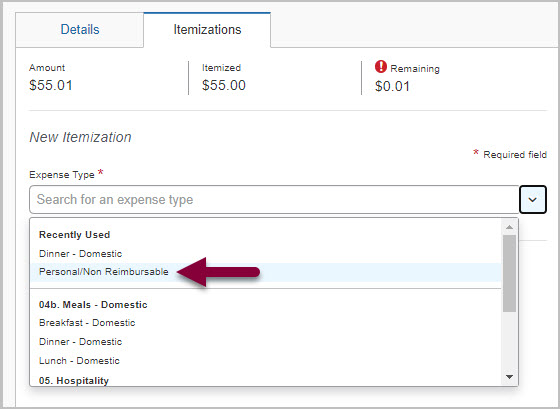

- Create another itemization, then select Expense Type Personal/Non Reimbursable.

- Enter the remaining balance of the expense. The "personal expense" box should be checked.

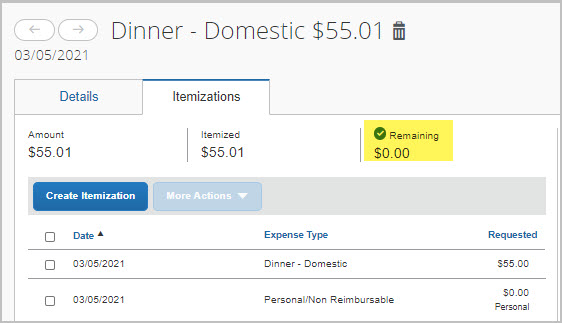

- After saving, you will see a summary of the itemized expense. It should show $0 remaining.

Amount is Due to Traveler

If your Expense Report contained some out-of-pocket expenses, any personal expenses you incurred will be deducted from the amount of your reimbursement.

NOTE: You will receive a violation.

Amount is Due to University

If your Expense Report did not contain any out-of-pocket expenses and you now owe money to CSUDH, please DO NOT submit your report until you have followed the steps below. If you do not do this step correctly, your balance due will not clear.

Amount is Due to University

If your Expense Report did not contain any out-of-pocket expenses and you now owe money to CSUDH, please choose one of the below options and follow the steps. If you do not do this step correctly, your balance due will not clear.

There are 2 options for reimbursing the Travel Card

Pay online via card, or pay at Cashier's Office using cash or check.

Paying Online Via Card

- Pay online.

- Print receipt as PDF.

- Attach receipt to Concur Expense Report. Now you can submit the Expense Report.

Paying at Cashier's Office (with cash or check)

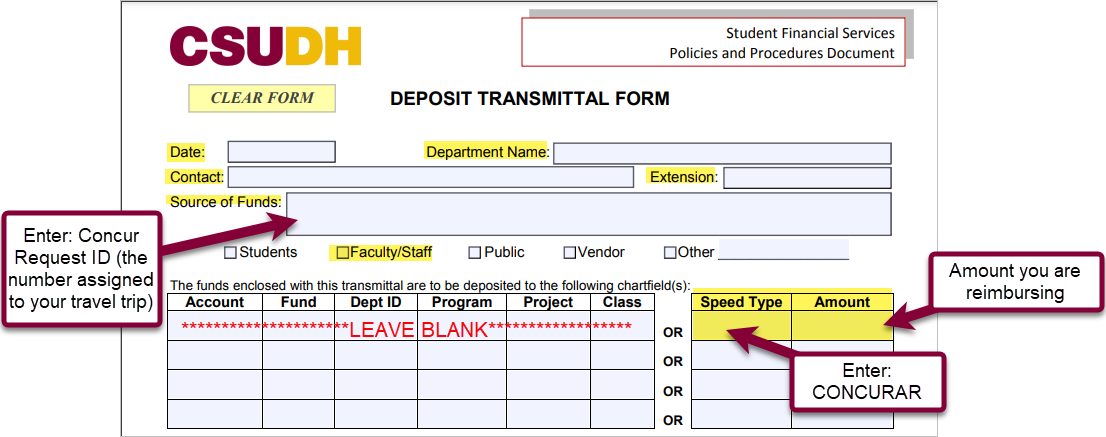

- Complete a Deposit Transmittal form. See instructions below. Complete only the highlighted fields.

- Take cash or a personal check to the Cashier's Office. Cards are not accepted there.

- Attach a copy of your Cashier receipt to your Expense Report in Concur. Now you can submit the Expense Report.

NOTE: If you submit your Expense Report without the required Cashier receipt, the Expense Report will be rejected by the Travel Desk.

- Complete a Deposit Transmittal form. See instructions below. Complete only the highlighted fields.