Independent Contractor

Latest News

Policy Overview

The purpose of this policy is to provide direction, clarification, and best practices for the engagement of independent contractors within CSUDH. These new procedures became effective as a result of Dynamex Operations West, Inc. v. Superior Court [PDF], the California Supreme Court's adoption of a single test for determining whether a person is an employee or independent contractor. The test, which is now referenced as the “Dynamex Test,” requires significant changes to how CSUDH determines the employment relationship.

In light of the Dynamex Test, before services are performed, CSUDH must assess the relationship between the individual and the campus to ensure that the individual is properly classified. Misclassification of a worker as an independent contractor can result in serious wage and benefit obligations, financial penalties, tax consequences, and other liabilities.

The court ruled that establishing such a classification can be best determined by the “ABC Test” as set forth below:

- The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract and in the actual performance of the work.

- The worker performs work that is outside the usual course of the hiring entity’s business.

- The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed.

All three abc test criteria must be met to be paid as an independent contractor. Otherwise, the worker must be hired as an employee per the State of California Supreme Court Dynamex Operations West decision regardless of if the IRS 20 Factors have been met, and must be paid wages via payroll. Examples of worker roles that must undergo this qualification process include, but is not limited to, Lecturers, Instructors, Advisors, Guest Speakers / Teachers, and Researchers.

For more information, please view the CSU Independent Contractor Guidelines – Independent Contract vs Employee Determinations Technical Letter HR/Salary 2021-07 [PDF], dated April 19, 2021.

Work must not commence until a Purchase Order has been executed

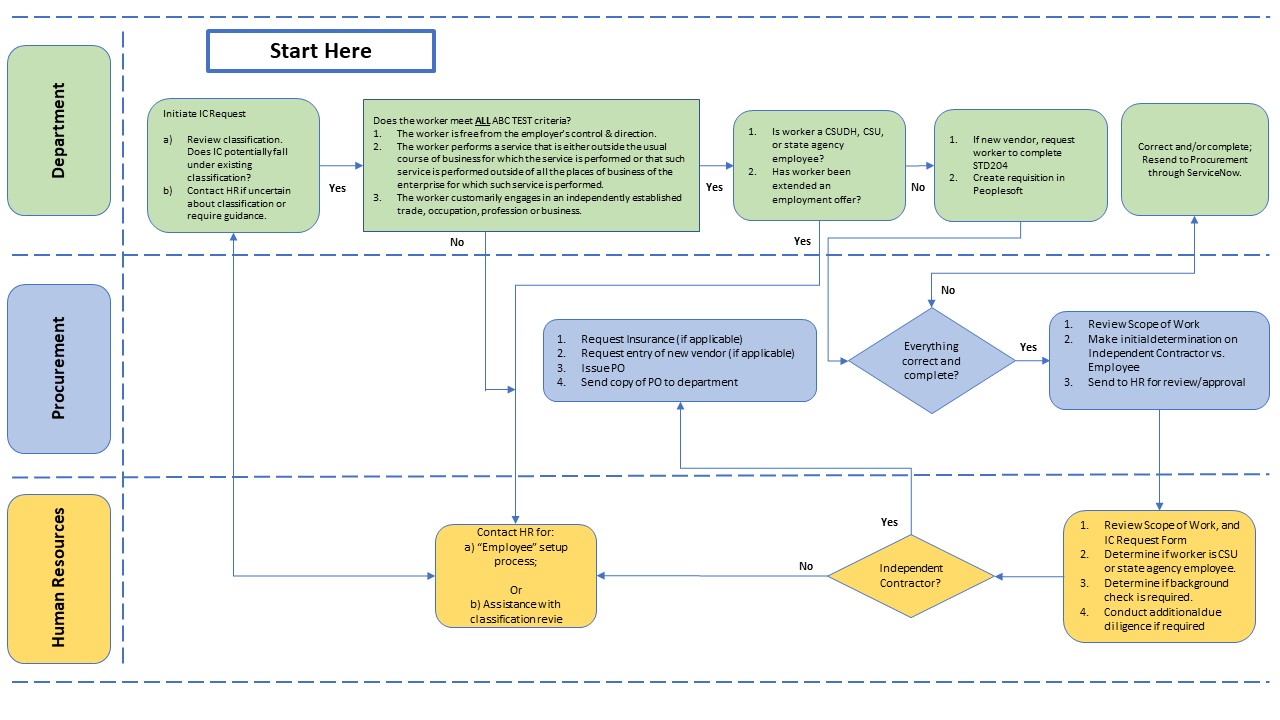

Department Processing Instructions

- Obtain the worker’s scope of work/proposal detailing, at a minimum, the services to be provided, service timeframe, and itemized costs. This information will be needed to complete the Independent Contractor Form.

- Determine if the proposed services fall under an existing CSU classification (contact HR for questions).

- If the worker should be designated as an independent contractor, complete the following:

- Request that the worker complete STD204 [PDF] (if new vendor); please notify procurement once the STD204 has been uploaded by the worker.

- Create a requisition in PeopleSoft.

- Complete and obtain Department Head’s signature for the Independent Contractor Request on Service Now. Using the Independent Contractor Request Form, determine the worker’s:

- Relationship with the University (Section 2)

- Ability to meet all ABC test criteria (Section 3)

- Classification designation (Section 4)

Note: If the worker does not meet the criteria for an Independent Contractor, please contact Human Resources at extension 3771 to process the worker as an employee.

Independent Contractor Checklist (Old Form)

The IC Checklist may be used for services performed before June 3, 2021. Departments may continue to use the prior IC request process to request payment. This process consists of completing the Direct Pay form (leave category blank and include pertinent information in the description box), Service Invoice, and IC Checklist. Submit the request to accounts payable for processing.

Services performed after June 3, 2021 shall follow the requirements of the new IC process.

All requests for independent contractors must go through both the Procurement and Contracts and Human Resources departments to determine whether or not the worker can be categorized as an "independent contractor." Note that AB5 assumes that all workers are considered "employees" until certified otherwise by the criteria outlined by the new regulation.

Procurement & Contracts Requisition Review / Processing

- Upon receipt of the requisition, conduct review of submitted documentation and requisition.

- Contact the department and/or worker for additional documentation and/or clarification.

- Send to Human Resources for final review / approval.

- Once approved by Human Resources, obtain certificate of insurance, process the requisition, notify the requesting, and IC department when complete, as applicable.

Human Resources Review / Processing

- Render final decision on Independent Contractor or Employee after reviewing submitted documentation.

- Request for additional documentation if required, inclusive of background check if applicable.

- Contact the requesting department if the candidate is deemed an employee.

- Technical Letter HR/Salary 2021-07 [PDF]

- IC Policy & Procedures [PDF]

- Independent Contractor Request available on Service Now

- IC Process Work Flow [PDF]

- Scope of Work Template [PDF]

- What is an Employee vs. Independent Contractor?

- Employee: An individual in an employment situation in which the employer has the right to control and direct the individual with regard to the result to be accomplished and the process by which the result is accomplished.

- Independent contractors: Individuals who render a service and meet contractor conditions established by the IRS. They typically have a separate workplace, are not supervised, and have a particular set of skills not available elsewhere within the organization. They are not entitled to employee benefits, are not covered by workers' compensation.

- What is AB 5 and what does it do?

- AB 5 is a bill the Governor signed into law in September 2019 addressing employment status when a hiring entity claims that the person it hired is an independent contractor. AB 5 requires the application of the “ABC test” to determine if workers in California are employees or independent contractors for purposes of the Labor Code, the Unemployment Insurance Code, and the Industrial Welfare Commission (IWC) wage orders. The California Supreme Court first adopted the ABC test in Dynamex Operations West, Inc. v. Superior Court (2018) 4 Cal.5th 903. Among other things, AB 5 and later AB 2257 added a new article to the Labor Code addressing these issues (sections 2775-2787).

- What is the Dynamex ABC Test?

- Under the ABC test, a worker is considered an employee and not an independent contractor, unless the hiring entity satisfies all three of the following conditions:

- The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact;

- The worker performs work that is outside the usual course of the hiring entity’s business; and

- The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

- Under the ABC test, a worker is considered an employee and not an independent contractor, unless the hiring entity satisfies all three of the following conditions:

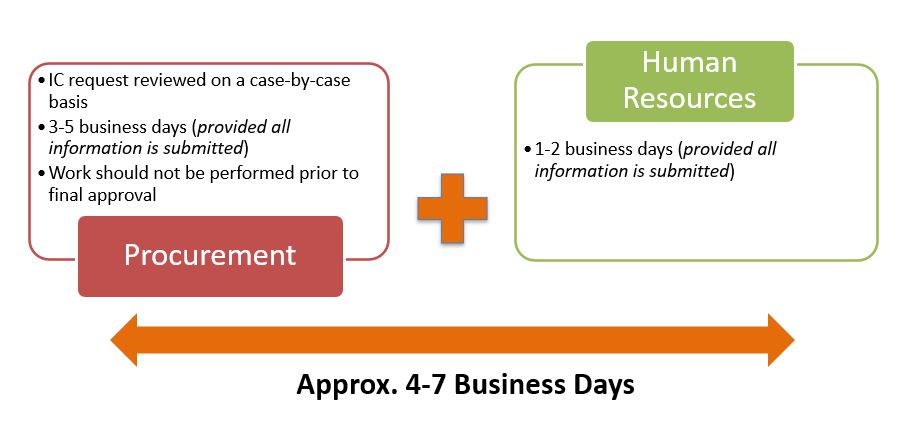

- What are the Procurement and HR review timelines?

- Public Contract Code Restrictions for CSU Employees - FAQ

- Important: This FAQ addresses restrictions resulting from Senate Bill 41, IRS rules and CSU Conflict of Interest Code. Additional and outside employment opportunities for CSU employees also may be limited by restrictions in other state laws and collective bargaining agreements, not addressed in this document.

- Restriction 1

A CSU employee, except for those employees with teaching or research responsibilities, may not “contract on his or her individual behalf as an independent contractor with any California State University department to provide services or goods.” (PCC 10831)

Can a CSU employee contract with a state agency other than the CSU to provide a needed service?

No, because the state agencies all make payments to employees as a single employer through the State Controller’s Office. The Internal Revenue Service (IRS) requires that all payments made by a single employer to an employee be reported on a W-2, not on Form 1099.

Can a CSU employee with a specialized skill or expertise contract with the CSU to provide a needed service?

No. This violates the CSU Conflict of Interest Code. Additionally, as noted above, the IRS would require that payment be reported to the individual as an employee on a W-2.

Are there any exceptions?

No.

How can a CSU employee provide a needed service to the CSU?

The CSU employee can be hired as an employee of the CSU (e.g., utilizing the “special

consultant” classification), as long as the employment is not funded by a CSU contract with a

vendor to perform services for or on behalf of the vendor).

Can a CSU employee be employed by and/or contract with a CSU foundation or auxiliary to

provide a needed service or expertise?

CSU employees can be employed by or contract with the CSU foundation or an auxiliary,

provided that the employees’ activities are not funded by a CSU contract between the CSU

foundation or auxiliary and meet the definition of Independent Contractor.

Can a CSU employee receive a “stipend” or “honorarium” payment though Accounts Payable

for services provided to another CSU campus?

No.

- Restriction 2

A CSU employee, except for those employees with teaching or research responsibilities, may not engage in any employment or activity for which the employee receives compensation through or by a CSU contract, unless the employment or activity is within the course and scope of the employee’s regular CSU employment. (PCC 10831)

Can a CSU employee have his/her activities funded by a CSU contract?

No.

Can a CSU employee provide a needed service or expertise to the CSU if the employee is hired by a private sector entity to do work that is funded by a CSU contract?

No.

Does this restriction apply to employee contracts with a CSU auxiliary, where the auxiliary has contracted to perform a service for CSU?

Yes.

What determines if an employee’s work on an activity funded by a CSU contract is within the course and scope of the employee’s regular CSU employment?

A CSU employee's position description or employment agreement may identify activities that the employee might be required to perform on an activity funded by a CSU contract. However, it may be that an activity is only an occasional part of the employee’s job, and not specifically identified in the position description, but is within the course and scope of the employee’s regular employment. The CSU, as the employer (not the employee), appropriately determines whether the activity is within the course and scope of the employee’s regular CSU employment. If the CSU appropriately designates the activity as within the course and scope of employment, the employee can be compensated as an employee.

- Restriction 3

For two years following retirement or separation from CSU employment, no former employee may enter into a contract “in which he or she engaged in any of the negotiations, transactions, planning, arrangements, or any part of the decision-making process relevant to the contract while employed in any capacity by any CSU department.” (PCC 10832 (a))

Do “negotiations, transactions, planning, arrangements, or any part of the decision-making process relevant to the contract” include technical support?

If the separated employee provided limited technical support to the planning or procurement

process as requested, but did not participate in planning or decision-making, the restriction does

not apply.

Can a separated/retired employee be rehired by the CSU as an employee to provide a service related to the selected vendor’s contract?

Yes. However, the timing of the hire must not conflict with CalPERS re-employment restrictions.

Can a separated/retired employee who participated in the planning or procurement process contract with the CSU to provide a service related to the selected vendor’s contract?

Yes.

Can a CSU employee who participated in the planning or procurement process relevant to a proposed contract enter into that same contract after he/she retires or is otherwise separated from CSU employment?

No.

Can a separated/retired employee who participated in the planning or procurement process contract with the selected vendor to assist the vendor in meeting its CSU contract obligations?

Yes.

Can a separated/retired employee be hired as an employee by the selected vendor to assist in meeting the contract obligations?

Yes.

- Restriction 4

For 12 months following retirement or separation from the CSU, no former employee may contract with the CSU if he or she was employed by the CSU “in a policymaking position in the same general subject area as the proposed contract within the 12-month period prior to his or her retirement…or separation.” Exempted are contracts for expert witness services and contracts to continue attorney services. (PCC 10832 (b))

What is a policymaking position?

An employee in a policymaking position sets or recommends CSU policy. Management Personnel Plan administrators are in policymaking positions. Network analysts generally are not in policymaking positions. Each campus must review a separated/retired employee’s prior position to determine its policymaking impact.

What does “in the same general subject area” mean?

This language should be interpreted broadly. If an employee specialized in one area of, for example, human resources, that employee would be subject to the 12-month restriction from all areas of human resources. If a campus academic administrator managed the Business school, s/he could not contract for work developing a business curriculum.

Can a CSU employee in a policymaking position who retires/separates provide services in his/her subject area on a contract basis to the CSU within 12 months of separation?

No. There are two limited exceptions: Contracts for expert witness services and contracts to provide continuing attorney services

Can a separated/retired employee in a policymaking position contract with a different CSU campus to provide services in the same general subject area?

No. Even though CSU campuses and the Chancellor’s Office are separate employers, for the purpose of this restriction, a systemwide preclusion applies.

How can CSU secure needed expert services or skills of former employees?

CSU can hire former employees as continuing CSU employees. This restriction does not prohibit the rehire of former employees or retirees. However, the timing of the retiree hire must not conflict with CalPERS re-employment restrictions.

Can a CSU employee in a policymaking position who separated/retired provide contract services to another state agency other than the CSU within 12 months of separation in any area of expertise?

Yes. This restriction applies only to CSU contracts.

Can a former employee in a policymaking position be employed by or contract with a foundation or other auxiliary to provide services to CSU in his/her subject area?

Yes. However, if the former employee is retired, the timing of the retiree hire and work to be performed must not conflict with CalPERS re-employment restrictions.

Can a former employee in a policymaking position provide needed service or expertise to another state agency, if that agency has a contract with the state?

Yes. However, if the former employee is retired, the timing of the retiree hire and work to be performed must not conflict with CalPERS re-employment restrictions.

- Restriction 1

- Important: This FAQ addresses restrictions resulting from Senate Bill 41, IRS rules and CSU Conflict of Interest Code. Additional and outside employment opportunities for CSU employees also may be limited by restrictions in other state laws and collective bargaining agreements, not addressed in this document.