Submitting Payments

Latest News

Paperless

In support of the campus' zero waste initiative, Accounts Payable is completely paperless.

Search a Keyword

Ways to Pay

A Purchase Order is the result of a Requisition. These functions of the Procurement office. Please review the Requisition Process Overview and contact Procurement for more information.

The Procurement Card is a program of the Procurement office. Please review the Procurement Card Policy and contact Procurement for more information.

The Direct Pay Form is an alternative to creating a Purchase Order (PO) or paying via Procurement Card. The types of purchases that can be paid for using a Direct Pay form are limited to the categories available in the drop-down menu near the top of the form. The authorized categories were determined by Procurement. If you do not see an appropriate category, please submit a requisition for a PO, in advance.

Allowable Categories Include

- Accreditation fees

- Advertisement (up to $1,000) – newspaper ad, job posting

- Books & pre-printed publications

- Decorations (materials only) for campus events - custom made items require a PO

- Certifications & program assessment fees

- Copyright fees and royalties – music, movie screening

- Payments to Auxiliaries - LSU, ASI, Foundation

- Payments to Government or State agencies

- Fingerprinting, background check fees

- Instructional supplies - (over $1,000 requires a PO) (computer hardware/peripherals/software/online subscriptions not allowed)

- Memberships & dues

- Postage fees – USPS, FedEx, UPS

- Training/conference registration fee – online/virtual with no travel expense

- Hospitality:

- Awards, Prizes, Incentives (PO required for custom goods)

- Campus event decor (materials only)

- Food & Beverage (PO required for outside on-campus catering)

- Promotional Items (below vendors only - all others require a PO)

- Promotions Dept

- 4imprint

- Alliance Printing

- American Solutions for Business

- Imagen

- Jack Nadel International

- DH bookstore

- Space Rental (LSU only) for events that require Hospitality

- Sponsorship

Unallowable Expenses Include

- Photographers, videographers

- Graphic designers

- Tshirt designers

- Tshirt printers

- Custom goods (promotional items) for vendors not listed in the previous section

- Performers

- Guest Speakers

- Services not listed above

- Services in excess of limits above

- Splitting up payments to circumvent the limits above

- Reimbursements for any type of services

- Information Technology subscriptions – software, online services

- Computer hardware

- Payments for goods or services that have not yet been received

- Payments to CSU employees for services (must go through Human Resources)

- Contracts or signed agreements – rentals, services, etc.

- Professional memberships that do not meet the requirements listed in the Memberships section

It is the practice of CSUDH to procure goods and services utilizing authorized procurement methods (Purchase Requisition, Procurement Card (P-Card), and Direct Pay). Employees who do not have a P-Card to purchase goods are encouraged to make arrangements with their department coordinator to purchase the item(s) on their behalf.

The use of personal funds for the procurement of goods and services is discouraged and is considered an unauthorized purchase. In the event authorized procurement methods are not utilized, employees should obtain authorization from the appropriate administrator to request reimbursement for expenses incurred on behalf of the University via Unauthorized Purchase Approval Request Form.

Travel reimbursements are not covered by this policy and follow the Travel Policy.

What if there isn’t an appropriate category on the Direct Pay form for the payment I’m requesting?

- If there is not a category for your purchase, it is not allowed to be paid via a Direct Pay form. Please contact Procurement to discuss your options, extension 3799.

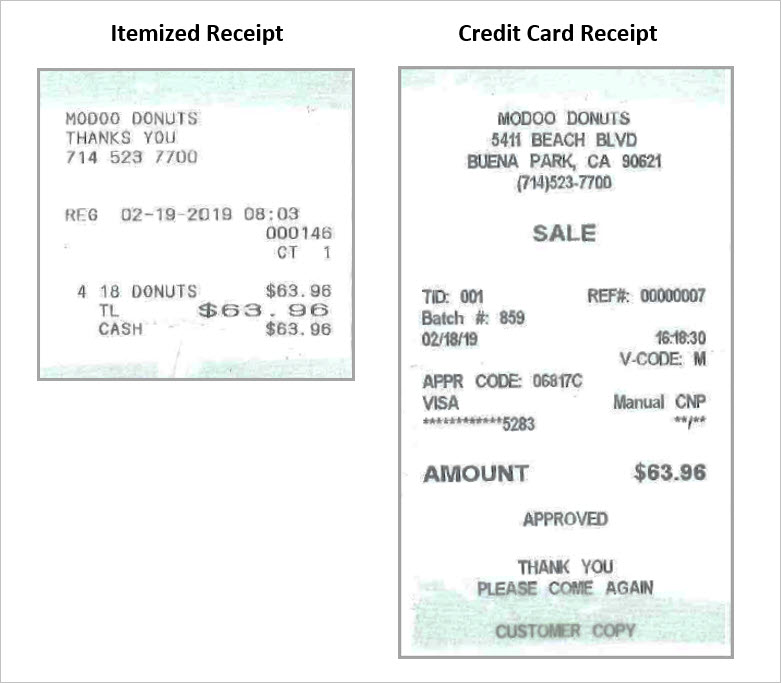

What type of support/substantiation must I include with my Direct Pay form?

- All Direct Pay forms submitted must be accompanied by an invoice or receipt that itemizes each item purchased. Credit card charge slips alone are not reimbursable. Additionally, reimbursements must include proof of payment.

- Some types of payments may require additional backup. For example, if the expense is considered Hospitality, an approved Hospitality form must be attached. Visit csudh.edu/accounting-services/ap/hospitality for additional information.

- For all payments issued to non-employees (including reimbursements), it is required that we have a completed Vendor Data Record (STD. 204) on file in Accounts Payable. If it is a first time vendor, they will need to complete the form and submit it electronically according to the instructions provided near the top of the form. For security reasons, the Vendor Data Record should not be submitted via email.

Will Accounts Payable accept an account statement to substantiate a payment request?

- No. An invoice that itemizes the goods or services being paid is required. A statement is not an acceptable form of substantiation.

What is an itemized receipt?

- An itemized receipt has ALL of the following pieces of information on it:

- Business Name

- Date

- Item(s) Purchased

- Price of Each Item

- Total Amount of Bill

- Method of Payment

- Notes about needing more than one piece of information to make up an itemized receipt:

- Sometimes you will need two receipts to show all of the necessary information. One receipt will show what was purchased, and the second receipt will show how you paid. Without both of these, your reimbursement request will be incomplete.

- Sometimes you are only given a document that shows the items purchased. This would most likely show the business name, date, item(s) purchased, price of each item, and the total amount of the bill. If you paid via credit card, attach the portion of your bank statement showing the amount on the invoice. Other times, you will be given a small receipt directly from the business showing that your credit card was charged. You should include both items in order to be reimbursed.

Will Accounts Payable accept a credit card charge slip to substantiate a reimbursement request?

- No. A receipt that itemizes the goods being reimbursed is required. Most business are happy to print a duplicate receipt for you.

Signatures

- Like invoices, the Direct Pay form must be signed by an approver with chartfield authority.

How can I find out who has chartfield signature authority or get someone added?

- The Fiscal Officer or Academic Resource Manager (ARM) of each Division is responsible for assigning and maintaining signature authority.

Why does the payment take 30 days?

- All vendor invoices are paid Net30 per campus policy. This means 30 days from the date of service or, for goods, 30 days from the date of invoice. Reimbursements to employees are paid due now, as are subscriptions/registrations.

Can I have the check sent to my department or can I pick it up?

- All checks should be sent directly to the payees.

To request an exception if you need to FedEx a check or include original signed documents with the check, please include a Special Handling Request with your payment request.

Are services allowed on the Direct Pay Form?

- No. See form drop-down menu for details. If you do not see it there, please contact Procurement to discuss your options (extension 3799).

Do I have to complete the Direct Pay form electronically or can I fill out a printed copy by hand?

- For timely processing, we request that the form be completed electronically. This will ensure that the form is legible and the most current version of the form.

- NOTE: Please complete all PDF forms in Adobe. Do not complete in your web browser because not all PDF functions are supported and may not work or display correctly.

What can I do to prevent my Direct Pay form payment from being delayed?

- Complete ALL fields, including “category” and “purchase justification.”

- If you do not see an appropriate category, do not submit it. Call Procurement.

- Include any additional backup documents.

- Attach only one invoice per form.

- Incorrect or incomplete Direct Pay forms will be mailed back to the requestor.

- If this is the first time the University has made payment to the vendor, the vendor will need to submit a Vendor Data Record (STD. 204).

- Combine all pages into a single PDF file.

- Make sure it is signed by someone with Signature Authority.

Can I use the Direct Pay form for Hospitality related expenses?

- Usually, yes. Please refer to the available categories. We do prefer that, due to the high volume, Campus Dining be paid using campus p-card. Events requiring signed agreements or contracts, such as retreats and facilities use, and outside vendors providing catering on campus (this is considered a service) is not allowable on Direct Pay and a requisition will need to be submitted in advance.

- NOTE: Approved Hospitality Authorization form must be included regardless of payment method.

If I received an invoice from a vendor or supplier, can I pay for the invoice and seek reimbursement afterwards.

- No. Invoices must be paid by the University directly via Direct Pay, Purchase Order, or Procurement Card.

If I am an employee and purchasing office supplies or business related items from an online vendor, can I have the items shipped to my home?

- No. All items must be shipped/delivered to a University campus business location.

- See Procurement policies for exceptions related to remote employees.

If I am seeking a business expense reimbursement, do I need to provide itemized receipts or proof of payment?

- Yes, receipts from the merchant indicating what was purchased, the cost, and proof of payment. A credit card receipt with no descriptive information of the items purchased and their costs is not sufficient.

- Acceptable forms of proof of payment include:

- Debit/Credit Card

- Credit Card/Bank Statements (please black out anything personal)

- Last four digits of credit card match that on receipt

- Checks

- Front and Back of a cancelled check

- Cash ($200 Max) - must include formal store receipt

- Debit/Credit Card

Can we accept a W9 in place of the Vendor Data Record STD 204 form?

- Per State Administrative Manual (SAM) section 8422.190, form STD 204 must be completed by suppliers. The purpose of the STD 204 form is to obtain payee information for income tax reporting and to ensure tax compliance with federal and state law. The STD 204 is required for any non-governmental entity or individual entering into a transaction that may lead to a payment from the state. Therefore, a completed, dated, and signed STD 204 with handwritten or electronic signature must be on file with the state before payments are disbursed. Because the CSU is a State agency, an STD 204 is required in lieu of a W9. A completed STD 204 is also required for non-state employees authorized to receive expense reimbursements.

Who is required to submit a Vendor Data Record STD 204 form?

- New vendors

- Vendors with updates to their entity

- Non-employees receiving reimbursement, including:

- candidates

- students

- current DH student employees receiving a travel reimbursement for travel not related to their employment

- Auxiliary entities at other CSUs

- Private School Districts

- Chambers of Commerce

Who is not required to submit a Vendor Data Record STD 204 form?

- Current DH employees

- Current DH student employees receiving a travel reimbursement for travel related to their employment

- Government entities such as City or State departments

- Public School Districts

- Refund recipients

Payments Requiring Additional Info or Approval

Payment requests for professional individual memberships are restricted and require additional backup.

Memberships, when in the individual’s name and personal address, are considered a personal expense which is considered a fringe benefit per the IRS, thus are not allowable. The benefits of the membership must be transferable to another individual should the original member separate from the campus.

In order to qualify as an allowable expense, the member data must look like this:

[NAME]

[TITLE]

CSU DOMINGUEZ HILLS

1000 E VICTORIA ST

CARSON, CA 90747

Again, this is the member data, not the billing info, and must be included in the backup for the expense, regardless of the payment method. One can typically login to their membership online and locate their member data. Screenshots are acceptable.

Lifetime memberships are not allowable. For budgetary purposes, the membership period should fall with the current fiscal year, thus memberships should not exceed one year in duration.

All expenses related to the publication of faculty work must be reviewed and approved for use of State funds, by the Provost Office.

- The use of non-state/auxiliary funds should always be considered first. State funds should only be pursued as a last resort.

- All expenses related to publication of faculty work should be handled following proper purchasing guidelines.

- When using state funds, Procurement procedures must be followed.

- A requisition must be entered in CFS (Common Financial System).

- Academic Affairs' Request for Publication Related Expenditures form should be uploaded along with other necessary documentation into the CFS system.

- Services may not be obtained until clearance from the Procurement & Contracts office is confirmed. This happens when the Purchase Order is dispatched to the vendor.

Failure to follow such procedures may result in your request being denied.

NOTE: Copies of publications/books are not permitted using state funds.

Branded clothing intended for employees is not considered promotional items or Hospitality. Clothing of a nominal value, $50 or less (per person per event) inclusive of tax, shipping, embroidery, or any other fees associated with customization, provided to employees are allowed as a regular business expense only if they are provided to promote or identify them for a specific campus-wide event such as NSO or Commencement. Student workers are also considered employees. Backup must clearly state the event name and purpose of the articles of clothing.

IRS rules state that clothing provided to employees are considered a taxable fringe benefit unless they fall under both exclusionary rules, which are:

- The item is specifically required to be worn as a condition of employment (required by contract or union agreement), and

- The item is not worn or adaptable to general usage as ordinary clothing

Also see the section Promotional Items & Customized Products for additional requirements.

Promotional Items (customized products) require University Communications and Marketing (UCM) approval. A customized product is defined as any product that is prepared specifically for the University. Promotional items are low value items distributed to students and the community to provide information and/or promote the name or image of the University.

Types of customized products include but are not limited to:

- Specialty imprinted or engraved products, including promotional items and screened or embroidered products such as clothing, keychain, coffee mug, calendar, etc.

- Printing services, including custom printed forms.

Customized Products are considered services and are prohibited on Direct Pay and P-card, with the exception of the following pre-approved vendors:

- Promotions Department

- 4imprint

- Alliance Printing

- American Solutions for Business

- Imagen

- Jack Nadel International

Cardholder must obtain approval from University Communications and Marketing (UCM) prior to authorizing ANY purchase. See below.

CSUDH Logo/Brand Identity Approval

The CSUDH logo is the core component of our visual identity system. It creates a distinctive graphic presence for our institution and serves as an instantly recognizable visual cue for our constituents. It expresses our brand through color, shape, typography, and style. Approved logos may be found on the UCM website. Endorsed logo variations combine the university monogram with a division/department/college/initiative name. DO NOT create your own endorsed logo. Contact brand@csudh.edu, to request approved art.

All artwork must be approved by UCM prior to making the purchase.

For approval, email brand@csudh.edu, and include the following information:

- Department requesting approval, including the Contact Person

- Phone number

- Email address

- Description of product (include item number, colors including imprint color(s) (ink/thread color(s) if applicable, etc.), logo placement, sizes (if applicable)

- A PDF mock-up of the artwork as an attachment

- What is the purpose of the item?

- Who is it for?

- Due date

Once approved by UCM, please include the email approval as backup to the expense.

In an effort to support and align with the CSU Single-Use Plastics policy that went into effect in 2018, Single Use Plastic Water Bottles, Straws, and Bags are not allowable for purchase or sale in accordance with the CSU Single Use Plastics Policy. The CSU Policy also highly restricts purchasing of single-use plastic water bottles with a complete ban on purchases and sales beginning January 1, 2023. In support of compliance with this policy, CSUDH has multiple other options for hydration including:

- Hydration/refill stations available at all campus water fountains in every building on campus.

- Reusable CSUDH co-branded Pathwater bottles available on a chargeback basis through the campus Logistics Department. Ordering instructions are as follows:

If you would like to order pre-filled aluminum reusable Pathwater bottles that are cobranded with the CSUDH logo, departments can place an order (by case of 12 bottles) directly with the campus warehouse by e-mailing Dino Hernandez at dhernandez@csudh.edu.

Please include:

- the quantity of cases you would like

- the campus location where you would like them delivered

- and your department chargeback chartfield information

Bottles are $18.60 per case ($1.55 each).

- Rentable water bar and dispenser options through Campus Catering to allow users to refill reusable water bottles at events.

As a result, the purchase of single-use plastic water bottles is restricted, will require special justification, and cannot be purchased using general funds. Budget/cost cannot be the sole basis of a justification request. Please submit justification to procurement@csudh.edu for review and approval. If approved, include approval as backup to payment request.

For prior-year expenses:

- Invoice for a closed PO that DID have enough funds left at the time of closure:

- submit on a Direct Pay form and send it directly to procurement@csudh.edu for approval

- include any necessary backup and additional forms

- include original PO# and ending balance in Direct Pay form justification field

- Invoice for a closed PO that DID NOT have enough funds left at the time of closure:

- submit on an Unauthorized Purchase Form and send it directly to procurement@csudh.edu for approval

- include any necessary backup and additional forms

- include original PO# and closed status in Direct Pay form justification field

- Invoice that fits into one of the allowable Direct Pay categories:

- submit on a Direct Pay form to the appropriate Portal

- include any necessary backup and additional forms

- Invoice that does not fit into any of the allowable Direct Pay categories (a PO would have been required)

- submit on an Unauthorized Purchase Form and send it directly to procurement@csudh.edu for approval

- include any necessary backup and additional forms

- Once approved, Procurement will forward it to Accounts Payable for processing

A sponsorship is a contribution to the cost of an event in return for advertising or promoting the University. This includes the cost of a vendor table at external events.

All sponsorship payments must include, as backup, a document from the vendor or from their website showing the requested sponsorship level and the benefits to be received.

Submission Portal (Employees Only)

Please select document type.

Upload Requirements

- File name: [VENDOR NAME] [INVOICE #], or for reimbursements: [EMPLOYEE NAME] [ AMOUNT]

- PDF file (Portfolios will be rejected)

- 1 single, complete file (combine all documents)

- 1 request per PDF file

- Approval signatures on form as well as backup documents, as applicable

- Invoice required

Quotes, ProForma invoices, statements, and order confirmations cannot be used to issue payments and will be rejected.

Please Note the Following

- Allow 15 business days processing time

- If there is a problem with your submission, you will receive an email from Accounts Payable

- After 15 days, check payment status

- Note that general campus payment terms are Net30, which means the payment won’t issue until 30 days after invoice date (for goods) or date of service

- If there still isn’t information available after 15 business days:

- Verify you received an upload confirmation email from Dropbox

- Check your email to see if you overlooked an email from Accounts Payable alerting you of a problem with your submission

- Contact payables@csudh.edu (provide the invoice number, payee name, and amount)

NOTE: If your payment requires special handling, please use the Special Handling Form instead.

Upload Requirements

- File name: [PAYEE NAME] [AMOUNT]

- PDF file (Portfolios will be rejected)

- 1 single, complete file (combine all documents)

- 1 request per PDF file

- Approval signatures on form

- Backup documenting original payment is required

Please Note the Following

- Allow 15 business days processing time

- If there is a problem with your submission, you will receive an email from Accounts Payable

- After 15 days, check payment status

- If there still isn’t information available after 15 business days:

- Verify you received an upload confirmation email from Dropbox

- Check your email to see if you overlooked an email from Accounts Payable alerting you of a problem with your submission

- Contact payables@csudh.edu (provide the payee name and refund amount)

Upload Requirements

- File name: [VENDOR NAME] [INVOICE #]

- PDF file (Portfolios will be rejected)

- 1 single, complete file (combine all documents)

- 1 invoice per PDF file

- PO# on invoice

- If the PO has multiple lines, indicate on the invoice which line(s) the invoice line(s) should be charged to

- Approval signature

Do not submit an approved invoice if you are waiting for a Change Order to be processed.

Quotes, ProForma invoices, statements, and order confirmations cannot be used to issue payments and will be rejected.

Please Note the Following

- Allow 15 business days processing time

- If there is a problem with your submission, you will receive an email from Accounts Payable

- After 15 days, check payment status

- Note that general campus payment terms are Net30, which means the payment won’t issue until 30 days after invoice date or date of service

- If there still isn’t information available after 15 business days:

- Verify you received an upload confirmation email from Dropbox

- Check your email to see if you overlooked an email from Accounts Payable alerting you of a problem with your submission

- Contact payables@csudh.edu (provide the invoice number, payee name, and amount)

NOTE: If your payment requires special handling, please use the Special Handling Form instead.

Upload According to First Letter of Vendor Name, as Shown on PO

All Documents Should be in the Following Format Upon Submission

- PDF file, as an attachment

- 1 single, complete file (combine all documents)

- 1 request per PDF file

- signatures in signature fields

Please Note the Following

- allow 15 business days processing time

- do not password protect files

- do not CC anyone on your submission (BCC okay)

- do not CC this mailbox on emails

- do not submit an email attachment

- do not include these mailboxes in Adobe Sign workflow

All Documents Should be in the Following Format Upon Submission

- PDF file, as an attachment

- 1 single, complete file (combine all documents)

- 1 request per PDF file

- signatures in signature fields

Please Note the Following